Alarm has been raised over the signing into law of the new Expropriation Act, which allows government at local, provincial and national level to expropriate land in very specific circumstances, with the possibility of zero compensation. Fortunately, however, this Act is simply an update of the 1975 Expropriation Bill, and it is essentially designed to prevent unnecessary delays with the provision of energy, water and logistics infrastructure. Most countries have similar regulations in place, without which progress with public works would be constrained.

The definition of expropriation remains a concern, but it is important to note that the new Expropriation Act's provisions are subject to the provisions of section 25 of the Constitution, which has not been amended. The latter section requires that compensation be just and equitable. The new Act contains many checks and balances, including guarantees that expropriation can only be used as a last resort after all other attempts to buy the property have failed.

Jurisprudence regarding the interpretation of the concepts of just and equitable compensation will only develop after substantial litigation has occurred and may take decades. The nil compensation provision may never even see the light of day. Until then, property ownership in general is secure and protected by a democratic Constitution that enshrines free enterprise principles. The bottom line is: Business as usual.

Prime Rate Down to 11%

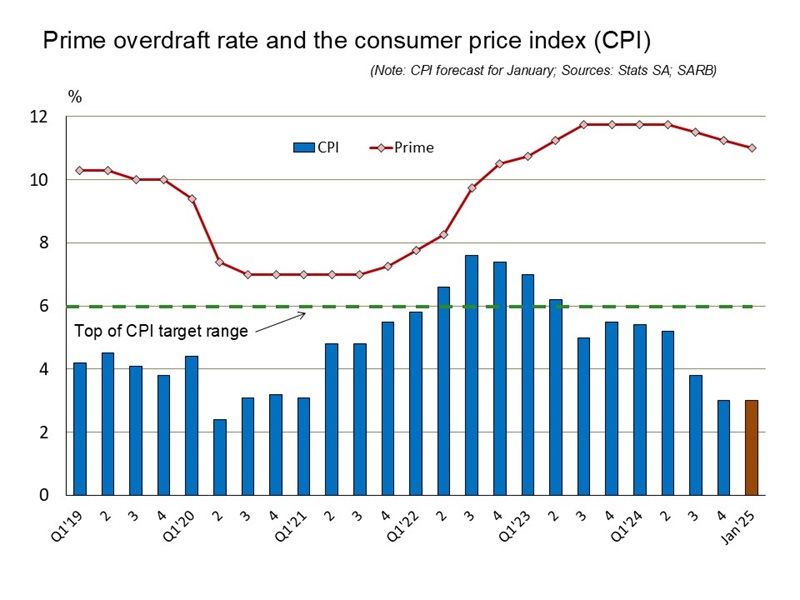

As widely expected, the Monetary Policy Committee (MPC) of the Reserve Bank lowered the repo rate by 25 basis points at its January meeting, following two similar rate cuts in September and November.

The decision should have been a foregone certainty, as the consumer price index (CPI) has dropped to the bottom of the MPC’s target range of 3% to 6%, whilst the producer price index (PPI) is hovering at just above zero. It is quite obvious that inflation is more or less under control, especially due to the normalisation of energy and freight shipping charges after the end of the Covid-lockdowns. It is also obvious that more needs to be done on the policy front to implement measures aimed at encouraging economic growth and employment creation.

It should be noted that higher inflation was never caused by excess demand but was entirely due to cost-push factors that are beyond the control of monetary authorities. Indebted households are now faced with a prime overdraft rate of 11%, which is better than the 11.75% that existed before September 2024, but still 100 basis points higher than the 10% that existed before the Covid pandemic. Hopefully, the MPC will not rely too much on uncertain and unpredictable factors such as the possible impact of US tariffs on exports but rather concentrate on the dire need to reduce the cost of capital and credit, thereby stimulating economic growth.

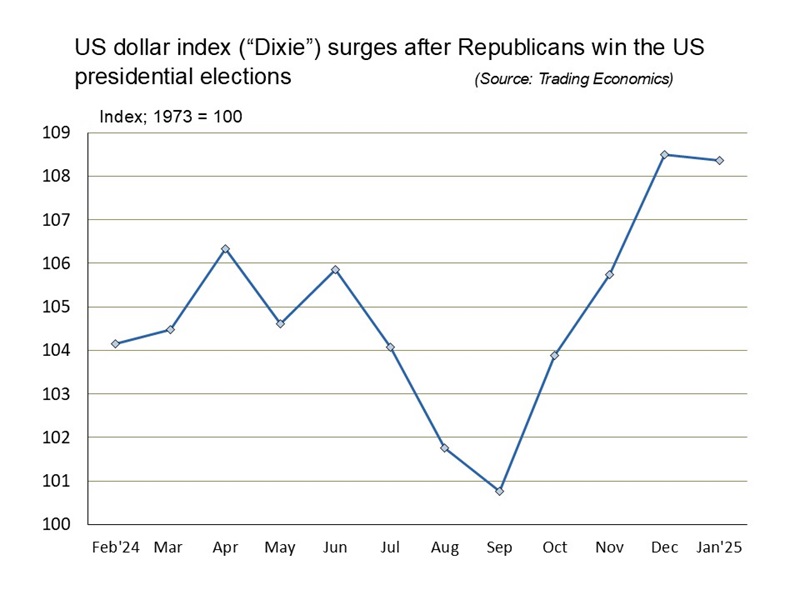

Global Currencies hit Hard by Resurgent US Dollar

The dollar continues to benefit from expectations that Pres Trump will levy tariffs on most of the major trading partners of the US, hurting currencies around the globe. Although January witnessed an element of dollar weakness due to uncertainty over the timing and extent of the new tariffs on goods exported to the US, it has become clear that tariffs will be slapped on Canada, China and Mexico early in February.

Most currencies were hit hard by the resurgent greenback, with the Indian rupee dropping to an all-time low, whilst the euro could drop to parity against the dollar again soon. Underpinning the strength of the US dollar is the assumption that Pres Trump’s America First vision will fuel demand in the country and halt the downward trend in the consumer price index, whilst delaying further interest rate cuts.

At the end of January, the US dollar index rose to above 108 for only the third time in more than three decades. As recently as September 2024, the so-called “Dixie” had dropped to 100 on the back of a fairly aggressive start to the rate cutting cycle, but the election of Pres Trump has, for now, put paid to prospects of dollar weakness. In the meantime, South African exporters should make the proverbial hay while the sun shines, as a weakening trade balance in the US will eventually halt the greenback’s upward march.