One would be embarking on a fool’s errand to try and gauge the full impact of the tensions within the government of national unity (GNU) and the 30% tariff slapped on South Africa by US President Donald Trump.

It is trite to waste time lamenting these extraordinary events and calm heads are now required by business leaders and the GNU to carefully plan a policy response.

Some industries stand to lose export earnings, but the search for expanding the country’s trade presence in non-traditional markets will almost certainly create new opportunities – especially in Saudi Arabia, the United Arab Emirates and Qatar, who have a combined value of agriculture imports of close to R1 trillion.

South Africa currently has a market penetration of less than 2% in these countries. For now, it is important to appreciate the fact that the services sectors represent 70% of South Africa’s GDP and the country enjoys the highest ranking in Africa for food security (availability).

Balance of payments in excellent condition

South Africa’s balance of payments with the rest of the world ended 2024 on a high note, with the gross gold and foreign exchange reserves reaching a new record high of more than R1.2 trillion.

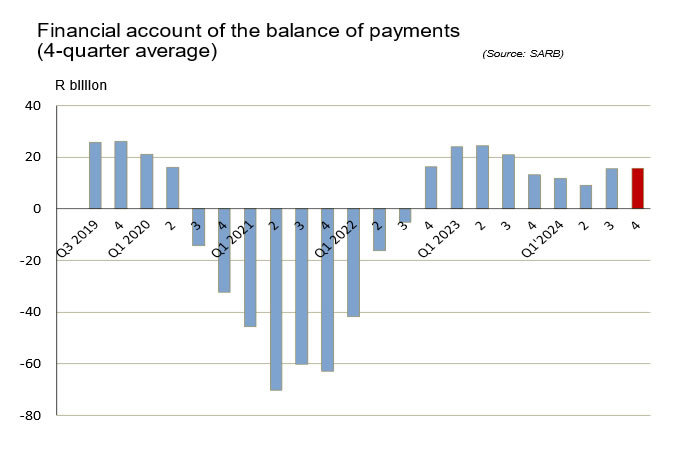

Despite a marginal net outflow on the financial account of the balance of payments during the fourth quarter, it ended the year with a surplus of R62.9 billion - an increase of 18.6% over the figure for 2023 and the third successive year that a surplus on this account was recorded.

Due to the traditional high level of volatility with financial account flows, it is prudent to analyse these data on a four-quarter basis, as depicted by the graph.

During the fourth quarter of 2024, the current account of the balance of payments recorded its second surplus of the year, namely more than R16 billion. This achievement was rather predictable due to a 41% surge in the value of gold exports (quarter-on-quarter), reaching a level of R150 billion for the full year.

The gold price continues to break new records and recently breached the level of $3,000 per fine ounce.

Producer price index at record low

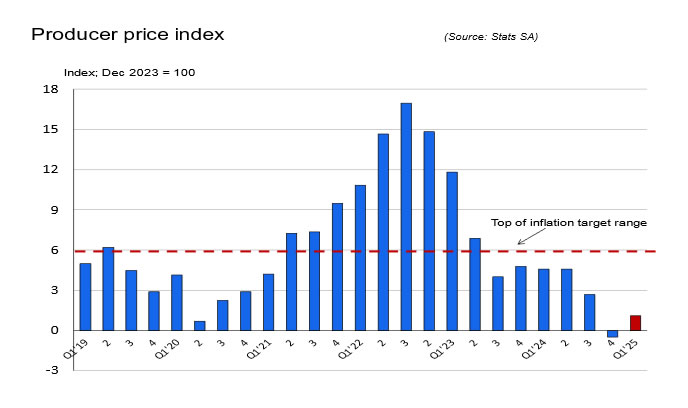

Price increases at the factory gate remain at their lowest level in more than two decades, with the producer price index (PPI) barely above zero. During the last two quarters of 2024, the PPI, as calculated by the Reserve Bank, recorded two successive quarters of negative readings for the first time since this data series has been kept by the country’s central bank.

Two of the main reasons for the new-found low-level stability of the PPI are year-on-year declines in the prices of vehicles and of fuel, whilst price increases for machinery and household appliances have also been muted.

The consumer price index is currently very close to the bottom of the inflation target range (3.2%), which translates into a benign inflationary environment.

Hopefully, the Monetary Policy Committee (MPC) of the Reserve Bank will take note of these trends and provide some relief for indebted households in May.

Optimism returns to agriculture

The Agbiz / IDC Agribusiness Confidence Index improved markedly in the first quarter of 2025 to a level of 69.6 (a level of above 50 denotes expectations of growth and vice versa). The current level of optimism is the highest since the end of 2021, a La Niña year that brought favourable rains across the country.

This phenomenon has returned, with good rains over the country’s key regions for crop, fruit and vegetable production, whilst the livestock industry stands to benefit from a welcome improvement in the grazing veld.

Progress with kick-starting PSPs

During March, Transport Minister Barbara Creecy launched an online request for information (RFI) process to test market appetite for potential private sector participation (PSP) investments in selected rail and port infrastructure and operations.

This information will help guide the development of the first PSP procurement phase, which could begin before the end of August.